Update 8/30/24: This increased welcome offer is going to be ending at 7am EST on September 5, 2024. Note that, for folks using household referrals, the current 40K referral bonus will be going down to 20K on September 2nd.

~

There is a fantastic new offer out for the Chase Ink Business Preferred that is good for 120,000 points after $8,000 in purchases in the first 3 months, matching the best that we’ve ever on the card. This offer has been available in-branch for a couple of weeks, but now it’s available publicly online.

Referral links are still showing the old 100K offer, but we’ve seen numerous data points of Chase matching folks to the 120K offer. If you applied recently through a referral, it’s worth checking in to see if you can be matched to this offer.

The Offer and Key Card Details

Click the name of the card below to go to our dedicated Frequent Miler page for this card, where you’ll find more information and a link to apply.

| Card Offer and Details |

|---|

120K points ⓘ Affiliate 120K after $8K spend in 3 months (Offer Expires 9/5/2024)$95 Annual Fee Alternate Offer: There is an in-branch offer of 120K points after $8K in purchases in the first 3 months. Recent better offer: 80K after $5K spend. Many preferred the 80K offer due to the much lower spend requirement FM Mini Review: Great card for welcome bonus and 3X categories. Also consider theInk Business Cash for its 5X categories, and the Ink Business Unlimited to earn 1.5X everywhere. Earning rate: 3X travel, shipping, internet, cable, phone, and advertising with social media sites (up to $150K spend per year) ✦ 5X Lyft through March 2025 Card Info: Visa Signature Business issued by Chase. This card has no foreign currency conversion fees. Noteworthy perks: ✦ Points worth 25% more when redeemed for travel ✦ Transfer points to airline & hotel partners ✦ Cell phone protection against theft or damage See also: Chase Ultimate Rewards Complete Guide |

Quick Thoughts

Any opportunity to earn 120,000 Ultimate Rewards is incredible and the modest spend requirement will make it much easier for many people to reach it here. Based on our current Reasonable Redemption Value (RRV) for Chase points, you should expect to get at least ~$1,800 in value from this offer. Wowza.

However, if you have someone in your household that already has an Ink card, it might be better to wait to see if the referral offer changes in the coming days. If the referral offer changes to this 120k/$8k offer, you could earn 120,000 Ultimate Rewards while your family member could pick up 40,000 Ultimate Rewards for referring you. That said, we have received numerous data points saying that Chase is being very generous in matching folks to this offer who had applied for the old 100K bonus, so there may be no need to wait.

Note that although this card is subject to Chase’s 5/24 rule, although you won’t be adding to your 5/24 count if you’re approved for it due to the Chase Ink Business Preferred card being a business card rather than a personal card. Learn how to check your 5/24 status here.

Am I eligible for a business card?

More:

You must have a business (but you probably do): In order to apply for a business credit card, you must have a business. That said, it's common for people to have businesses without realizing it. If you sell items at a yard sale or on eBay, for example, then you have a business. Similar examples include: consulting, writing (e.g. blog authorship, planning your first novel, etc.), handyman services, owning rental property, renting on airbnb, driving for Uber or Lyft, etc. In any of these cases, your business is considered a Sole Proprietorship unless you form a corporation of some sort.When you apply for a business credit card as a sole proprietor, you can use your own name as your business name, use your own address and phone as the business' address and phone, and your social security number as the business' Tax ID / EIN. Alternatively, you can get a proper Tax ID / EIN from the IRS for free, in about a minute, through this website.

Is it OK to use business cards for personal expenses? Anecdotally, almost everyone I know uses business cards for personal expenses. That said, the terms in most business card applications state that you should use the card only for business use. Also, some consumer credit card protections do not apply to business cards. My advice: don't use the card for personal expenses if you're not comfortable doing so.

How to apply for a Chase business card

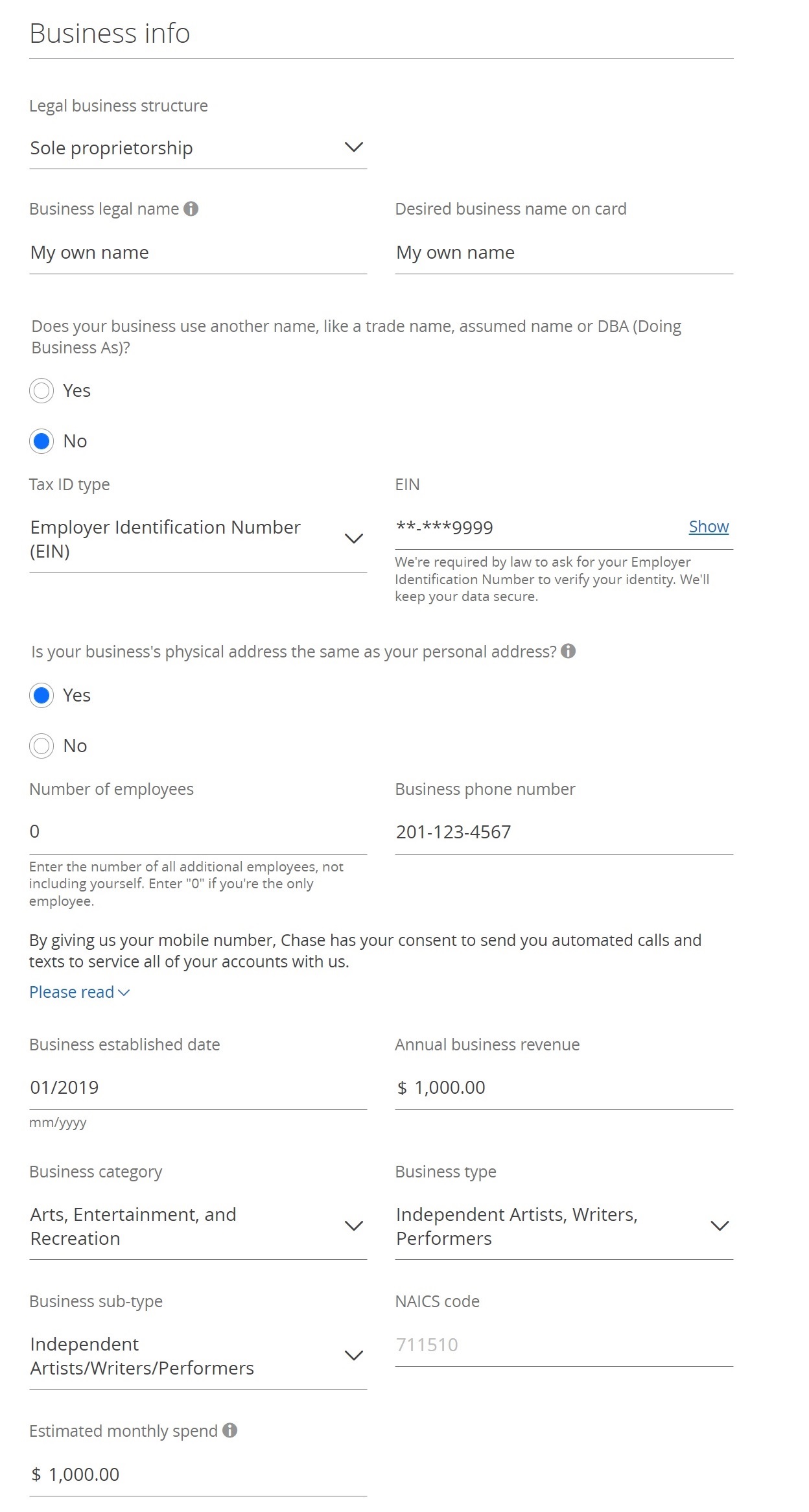

Here are example answers for the business part of the application:

Here are example answers for the business part of the application:

- Legal business structure: Sole Proprietor

- Business legal name: If you don’t already have a business name, I recommend using your own name as the business name.

- Desired business name on card: Again, this can be your own name if you don’t have a business name to use.

- Does your business use another name? No

- Tax ID type: EIN (you can get an EIN quickly and for free from the IRS here) If you'd prefer to use your social security number as your tax ID, select SSN rather than EIN.

- Is your business's physical address the same as your personal address? Yes

- Number of employees: 0 (the instructions say to enter the number of employees you have, not including yourself)

- Business phone number: Your phone number

- Business established date: When did your business start? If you've been doing your business for years (selling stuff at yard sales, for example), it's fine to estimate the starting date.

- Annual business revenue: $0 (or project an amount based on expected revenue)

- Business category, Business type, Business sub-type: Pick whichever categories are closest to your business. For example, an aspiring author, artist, or musician might choose: "Arts, Entertainment, and Recreation" and "Independent Artists, Writers, Performers."

- Estimated monthly spend: $3,000 (Use your judgement here. A higher number might lead to a larger credit line, but if it's too high it might negatively affect approval).

Check Application Status

After submitting your application, you can check status by calling the automated status line: (888) 338-2586

Check Application Status

After submitting your application, you can check status by calling the automated status line: (888) 338-2586

The post (Last week) Chase Ink Preferred Offer: 120K Ultimate Rewards points appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.