Many people don’t realize that Amex allows cardholders to earn Membership Rewards points by referring friends from one card to multiple different Amex cards. With most credit cards, you can refer friends only to the same exact card that you have. However, with some Amex cards you can refer friends to almost any Amex card.

This means that, when a friend or family member wants an Amex card that you don’t have, you can still earn points or cash by referring them from a different Amex card. Additionally, even if you have the card that your friend wants, you can refer them from a different card in order to earn a bigger referral bonus. In this post we’ll discuss how to find your referrals and how to decide which of your cards offers the most valuable referral rewards.

Below, you’ll find a handy video where Nick explains how to use a an Amex Gold card to create a link to the Delta Gold SkyMiles card so that your friend can open the SkyMiles card and you can get a Membership Rewards referral bonus on your Amex Gold card.

Key information regarding Amex multi-card referrals

Here’s a few things to know about Amex Multi-Referrals:

- Co-branded cards with their own rewards programs (Delta, Hilton, Marriott) can refer only to other cards within the same brand.

- Co-branded Membership Rewards cards (Schwab, Morgan Stanley) can refer a friend to multiple cards, but those cards receive cash back for every referral rather than standard Membership Rewards referral offers.

- Non co-branded Membership Rewards cards can refer to almost any card in the Amex portfolio (not including cards from Schwab and Morgan Stanley).

- Non co-branded cash back cards can refer to almost any card in the Amex portfolio.

- When you refer a friend to a card which earns a different type of reward, you will earn the rewards promised to you. E.g. if you start with a Membership Rewards card and refer someone to a Hilton card, you’ll earn Membership Rewards points for a successful referral.

- Annual earning limits are per card. For example, if you had both the Platinum and Gold Membership Rewards cards, you can ordinarily earn up to 200,000 points per year total even though each card is capped at earning 100,000 Membership Rewards points for referrals each year.

How to find your Amex multi-card referrals

To find your refer-a-friend offers, you can log into your Amex account and switch your focus card one by one. However, I think that the easiest approach is to log into the Amex Refer-a-friend site.

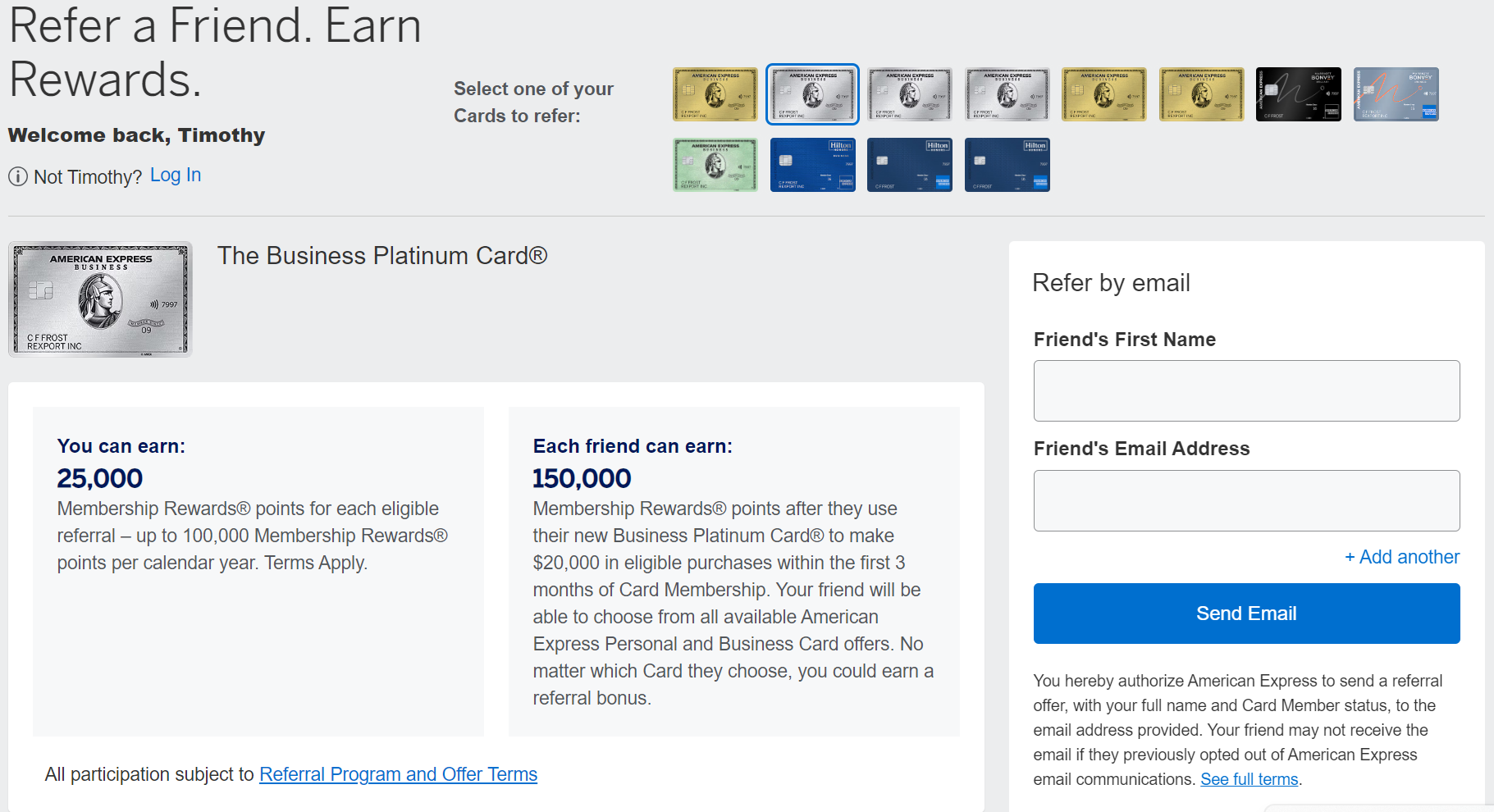

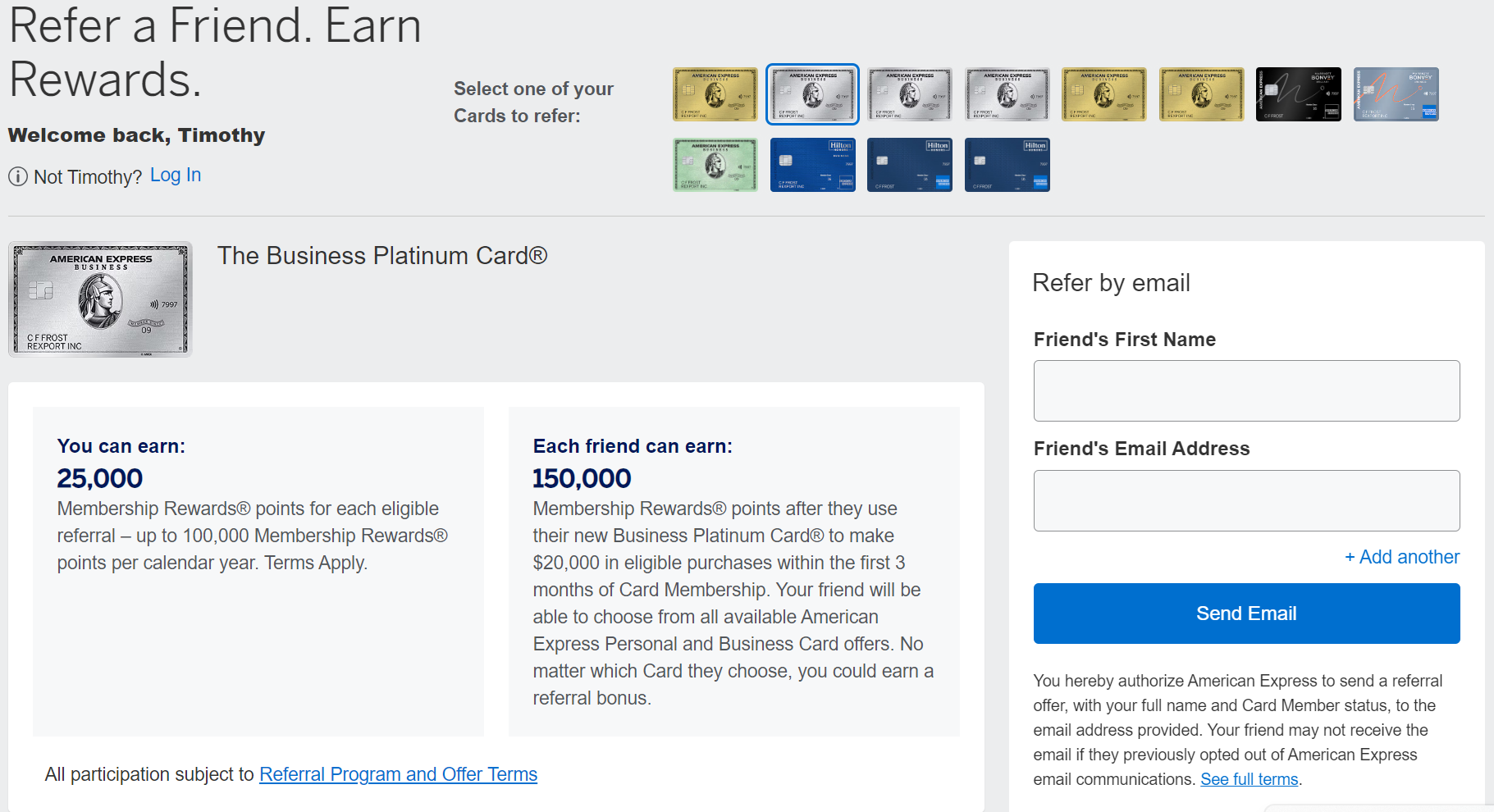

Once there, you’ll see a referral offer (if any are available for your Amex cards), and, if you have more than one offer, there will be a list of cards you can click to view the next offer, like this:

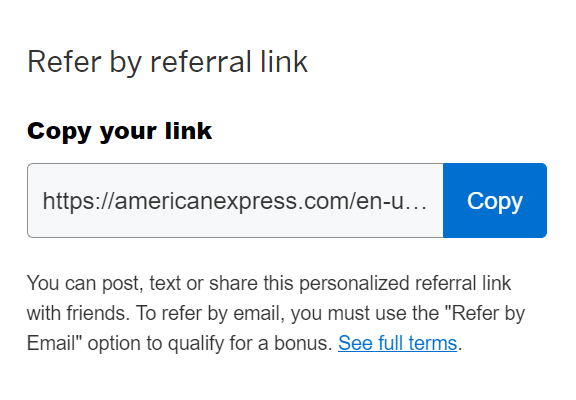

If you scroll down, on the right side you’ll see something like this:

Press “Copy” to get the referral link for the card you were viewing.

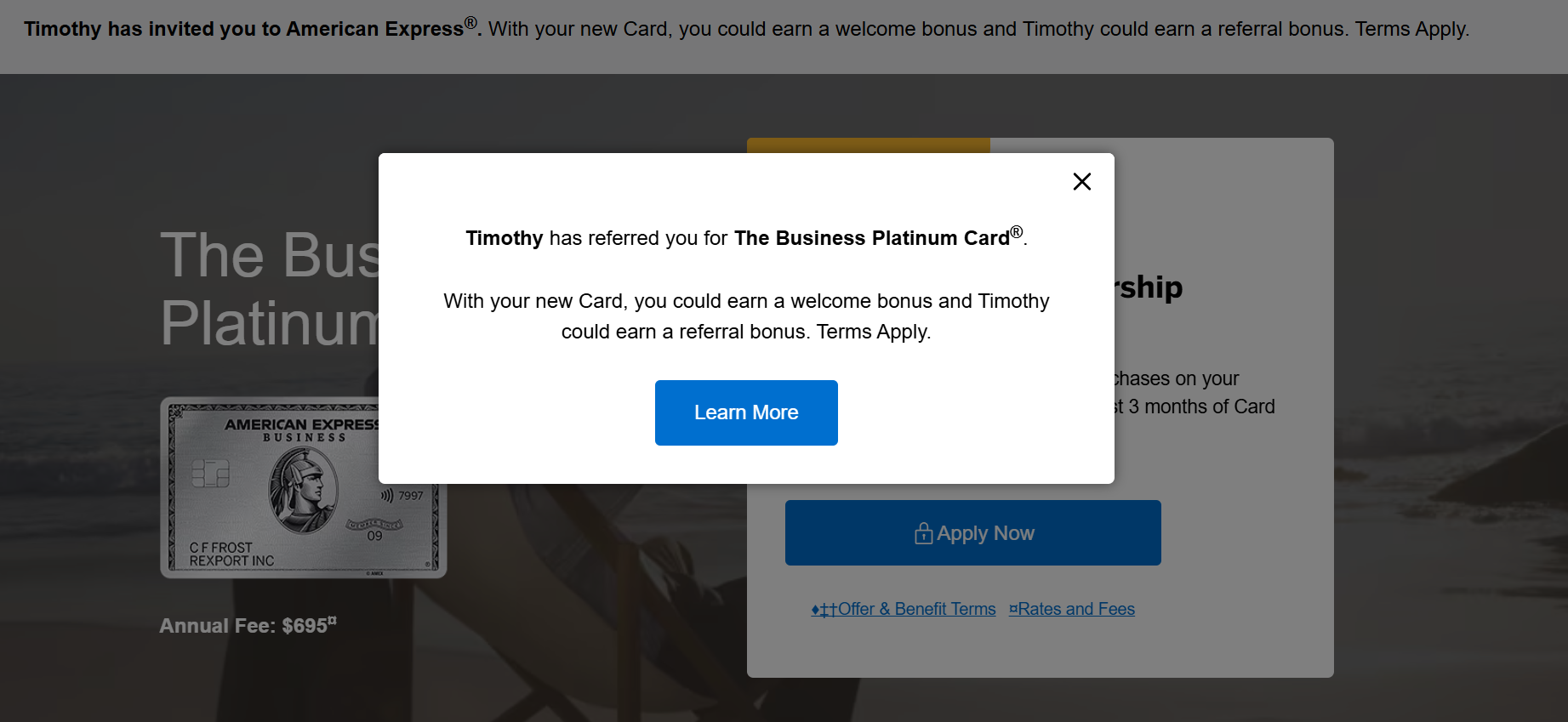

Next, paste that link into a new browser window. You may have to remove the extra text (remove everything up to “http://”):

Apply for an American Express Card with this link. With your new Card, you could earn a welcome bonus and your friend could earn a referral bonus. Terms Apply. https://americanexpress.com/en-us/referral/business-platinum-charge-card?ref=TIMOtSJJUi&xl=cp01

You will then see a direct referral screen (a referral to the same type of card that you started with):

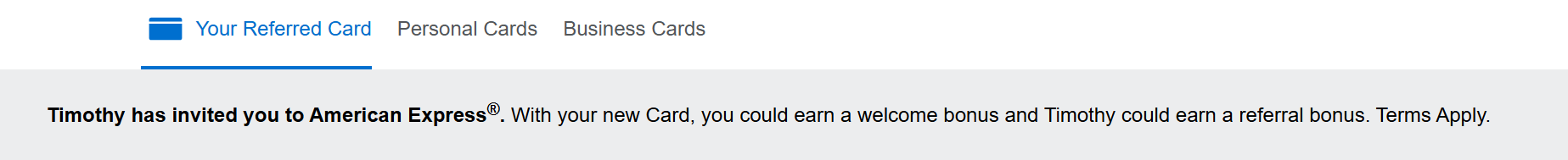

Press Continue, and above the offer you’ll see this:

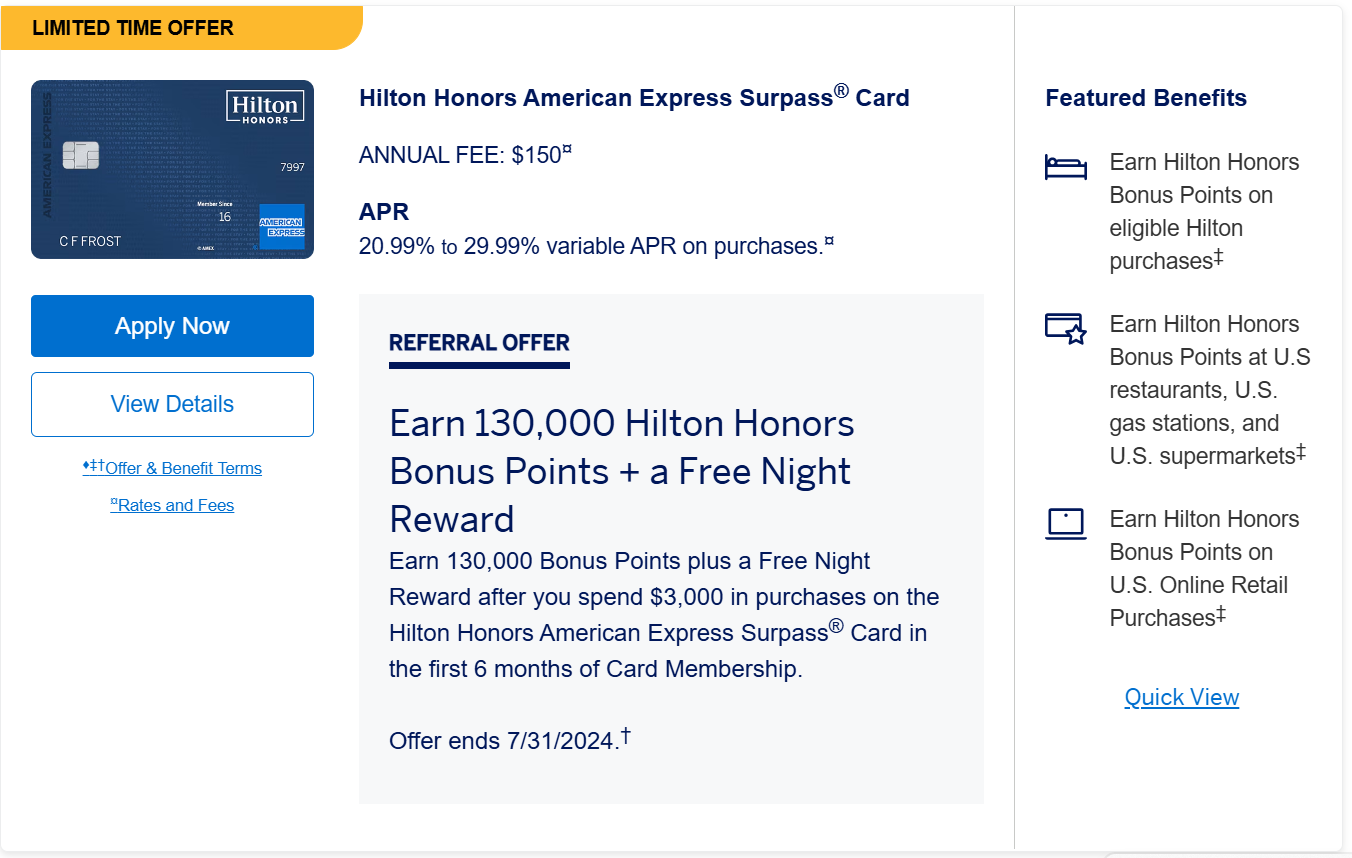

The above options let you find referrals to other cards besides the one you started with. For example, in the images above, I started with a Business Platinum card, but let’s say I want to refer my friend to a Hilton Surpass personal card. In that case, I would click “Personal Cards” and I’d see a bunch of personal card offers, allowing me to scroll down to find the Surpass offer for my friend:

Next, I would press “View Details” whereupon I’d finally see the referral page for the Hilton Surpass Card:

Finally, I’d copy the URL and email it to my friend. If my friend signs up through my link and is approved, I’ll earn my Business Platinum refer-a-friend bonus of 25,000 Membership Rewards points!

Picking the most valuable card

Referral offers change over time and can range from as low as 5K points per referral up to 35K or even 45K points per referral (though note you’re still limited to earning a total of 100K points from referrals on any single Amex card).

At a high level, picking the card to use for referrals is simple: choose the one you have that offers you the most value per referral.

Pay attention to maximum yearly limits

Most readers won’t have the “problem” of having too many referrals, but for those who do, consider the following:

Annual maximums are often not a simple multiple of the referral bonus. As a result, if you max out your referrals for one card, you will often earn fewer rewards with that last referral. For example, let’s the you have an Amex Gold Card that offers 45,000 points per referral, but with a 100,000 point limit. After you’ve successfully referred 2 friends, you would only earn 10,000 points for the sixth friend. For that third friend, you’d probably be better off using a different Amex card in your arsenal to refer them.

Similarly, if you think you may max out your best earning card, consider referring within brand when possible. For example, if you have both an Amex Platinum card and a Delta Reserve for Business card, you would probably prefer to earn 25K Membership Rewards per referral from the Platinum Card rather than 25K Delta SkyMiles from the Reserve for Business Card. However, if you’re pretty sure that you’ll max out your Platinum referrals, when a friend wants a referral specifically to a Delta card, you should consider using your Delta Reserve Card for those referrals (since that card can refer only to other Delta cards).

How referrals affect Amex card value

The ability to refer friends to multiple different Amex cards from one source card makes Amex cards more valuable than before. Consider, for example, a couple that tends to sign up for at least one new Amex card each year. The extra points they could generate through these referrals may be enough to justify keeping an Amex card that they were previously considering cancelling. For example, in the post “Is 4X worth $250 per year? How much are those Amex Gold 4X categories (grocery & dining) worth?” Greg offered a simply formula to help readers decide if the new Gold card is a keeper…but he didn’t include the value of referrals. If you filled out the formula and decided that you would cancel your Gold card when the annual fee came due, you may want to rethink that decision in light of the value of multi-referrals. An extra 15K or more Membership Rewards points per year might just make the card a keeper.

The added value of Amex cards is especially true for cards that tend to offer very high referral rewards (such as the Platinum and Business Platinum cards). In fact, this is one feature that the generic Amex Platinum card has which its branded rivals does not.

The post How to maximize value with Amex multi-card referrals appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.