Wells Fargo is out with a new cash back credit card called the Wells Fargo Attune World Elite Mastercard. This card looked marginally interesting at first glance, but the deeper I dig into it the more I think this could be a really interesting card for some categories that likely wouldn’t otherwise be bonused, like Disney World tickets, dance classes, marinas, campgrounds, tourist attractions and a lot more.

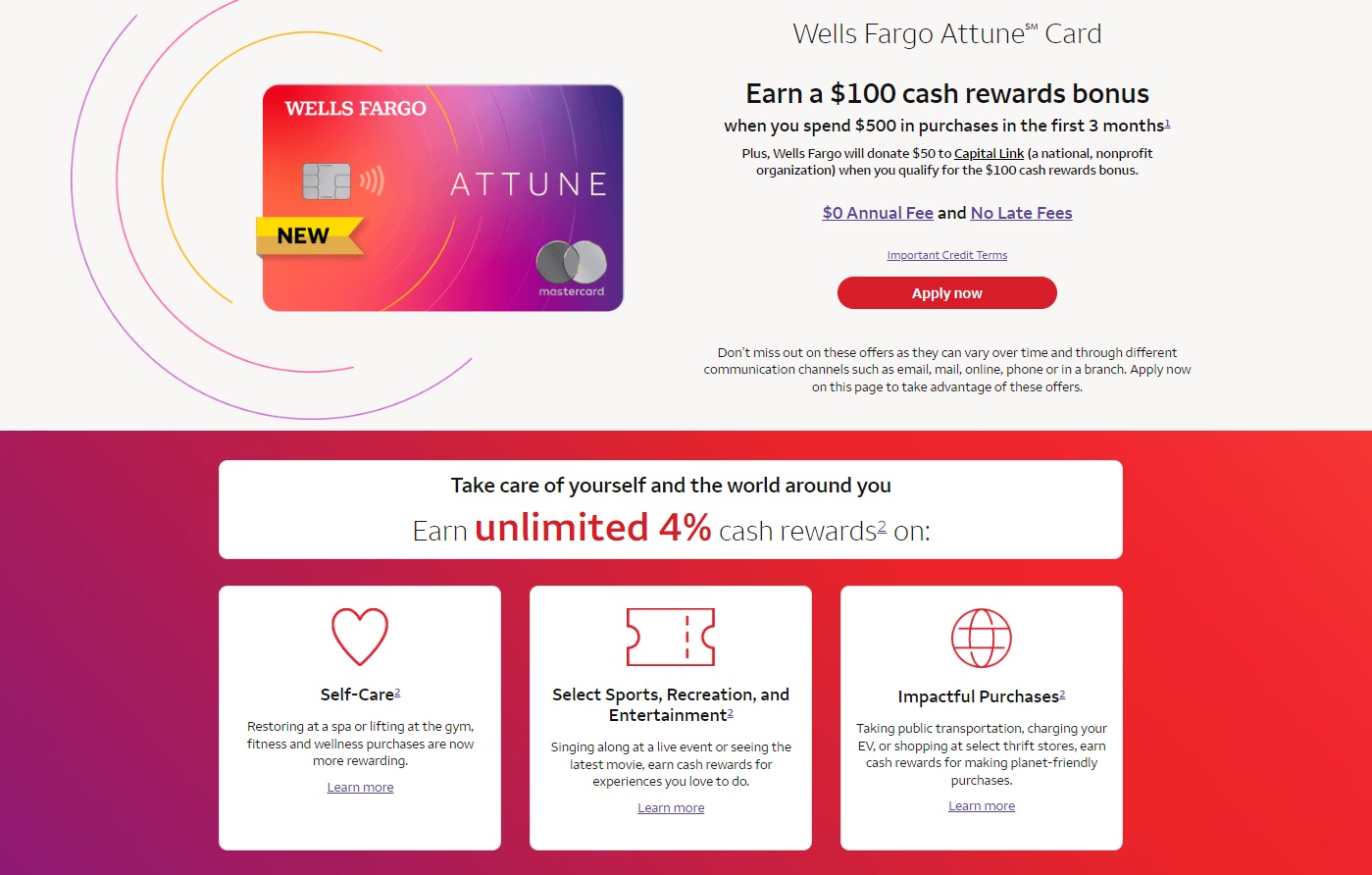

The Offer & Key Card Details

Click the name of the card below to go to our card-specific page where you can find more details and a link to apply.

| Card Offer and Details |

|---|

$100 Cash Back ⓘ Non-Affiliate $100 after $500 spend in first 3 months.No Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: This could be a good fit for those who spend a lot in the card's 4X categories. Earning rate: 4X self-care (gym memberships, at spas / massage parlors, and barber shops / salons) ✦ 4X sports, recreation, and entertainment ✦ 4X "planet-friendly purchases" like EV charging stations, riding public transportation, and purchasing select second hand and vintage ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Wells. This card imposes foreign transaction fees. Noteworthy perks: Cellular Telephone Protection |

Quick Thoughts

At first glance, I thought this card looked like a bit of a snoozer. It features a small welcome bonus that won’t draw in those chasing big rewards for intro spend and the headline spending bonus category is “4% back on self-care”, calling out “gym, fitness and wellness purchases” for that category. That’s nice for folks with a pricey gym membership, but it didn’t seem very broad.

Then there’s 4% back on “Sports, Recreation, and Entertainment” and 4% back on “Impactful Purchases”, which seemed clear as mud to me.

However, when I dug into the mud a bit, I found that self-care and This carThis sports, recreation, and entertainment encompass a huge range of qualifying types of purchases. If you have or lease a boat, pay marina fees, pay for dance school/studio lessons, park a trailer at a campground, go to Disney parks, or spend money on apparel from “fitness” brands, you can probably earn 4% back with this card.

Here are just some of the categories and/or example purchases Wells Fargo has on the card page that fit into either self-care or sports/rec/entertainment:

- Toy stores

- Etsy

- Disneyland / Disneyworld tickets and parking

- Trailer Parks and Campgrounds

- Tourist Attractions and Exhibit (they give examples like Summit One Vanderbilt, the Houston Zoo, and Kennedy Space Center)

- Public Golf Courses

- Dance Halls, Studios and Schools

- Get Your Guide operations (which makes me think Viator might also work?)

- Pet Care

- Bicycle Shops

- Sporting Goods stores (they list Eddie Bauer as an example!)

- Brand Retailers (Adidas, Asics, Nike, Under Armour)

- Marinas, Marine Service, and Supplies

- Boat Rentals and Leasing

- Motor Home and Recreational Vehicle Rentals

- Ticketmaster (and likely other similar sites)

- Patreon

- Barber shops / salons

- Spas / massage parlors

The above is not an exhaustive list. I was really surprised at the range of purchase types included. And the list of examples they give leaves me with some lingering questions. For instance, they list “Public Golf Courses” under examples of sports and recreation, but I wonder if membership fees at some private golf clubs may also code for 4% back (to be clear, the card details don’t suggest that they would, but I wonder if it’s a situation where it’ll vary based on the MCC of your club).

What really surprises me here is that there are quite a few categories here that might be big spend categories for some folks that otherwise go unbonused. Things like Marina fees, boat rental / leasing, and dance schools could conceivably be large spend categories for some folks. I originally mentally dismissed gym memberships, but those can also become fairly pricey — and for the right person, I could see this card offering 4% back on a number of types of purchases that otherwise go on an “everywhere else” card.

I also find it interesting to see the range of examples they give for things like tourist attractions — I could see this being a good card to use for domestic trips to pay entrance fees at a range of common tourist attractions. Just be sure not to use it outside of the US since it has a foreign transaction fee — and keep in mind that anything that doesn’t code at 4% will only earn 1% back, which is a very poor return on spend.

The Wells Fargo Attune card won’t be a great fit for me. I don’t have a gym membership or a boat and I don’t tend to spend much on spas or at salons, etc. However, I could easily imagine this being a nice complement to the right wallet.

The post New Wells Fargo Attune card offers 4% back on Disney tickets, dance classes, golf courses and more appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.