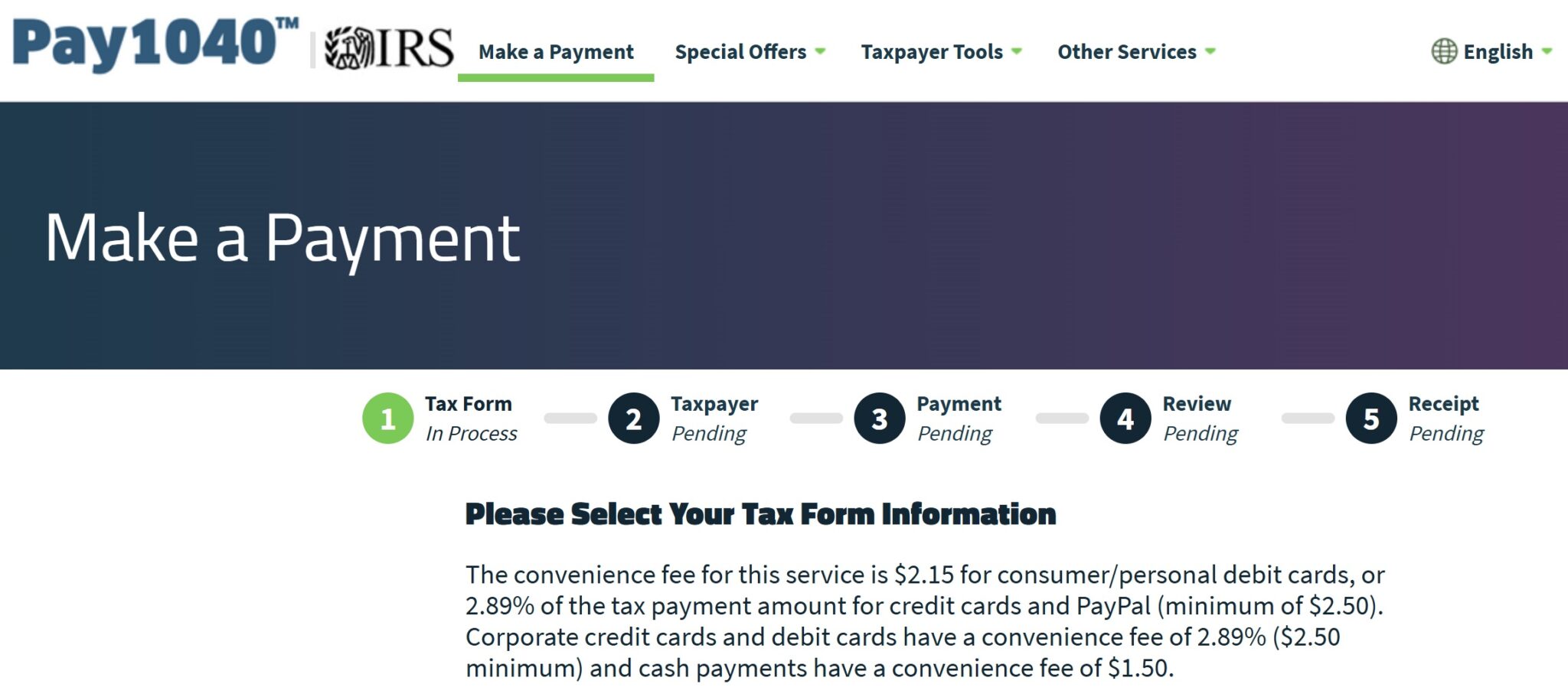

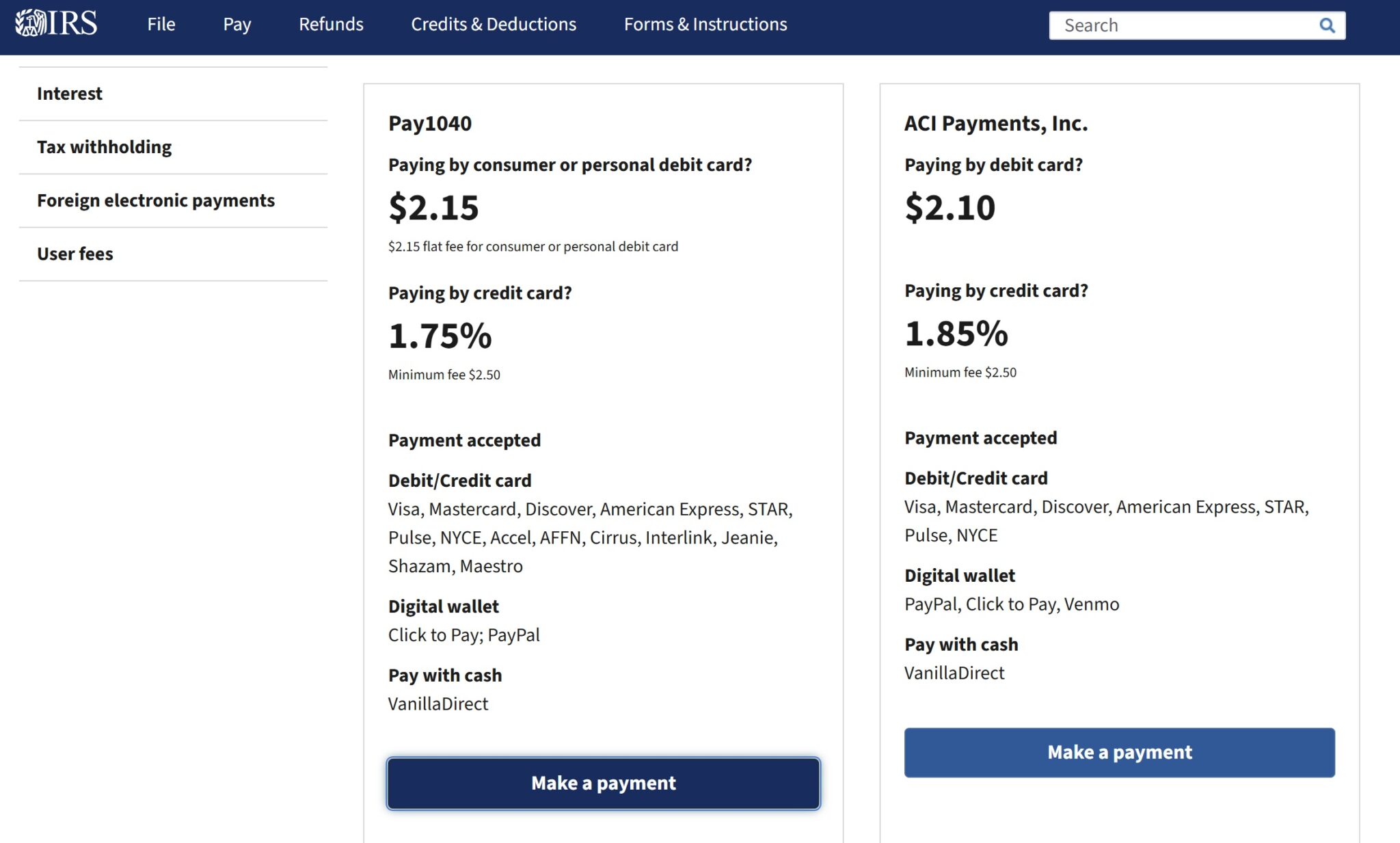

An eagle-eyed reader points out that while the IRS website lists the fee to pay taxes with a credit card as 1.75% at Pay1040, the fee shown on the Pay1040 website is now 2.89%. Not only does the landing page display that greatly-increased fee, but if you try to make a tax payment it does indeed assess a 2.89% fee during the checkout process. We don’t yet know whether the error here is on the IRS side or the Pay1040 side, but if you have a tax payment to make you’ll want to go with ACI Payments as things stand.

Reader Andrew pointed out this morning that he saw the increased 2.89% fee shown above when clicking through to make a tax payment today. This stands in contrast to the IRS website, which shows a fee of 1.75% for Pay1040 at the time of writing.

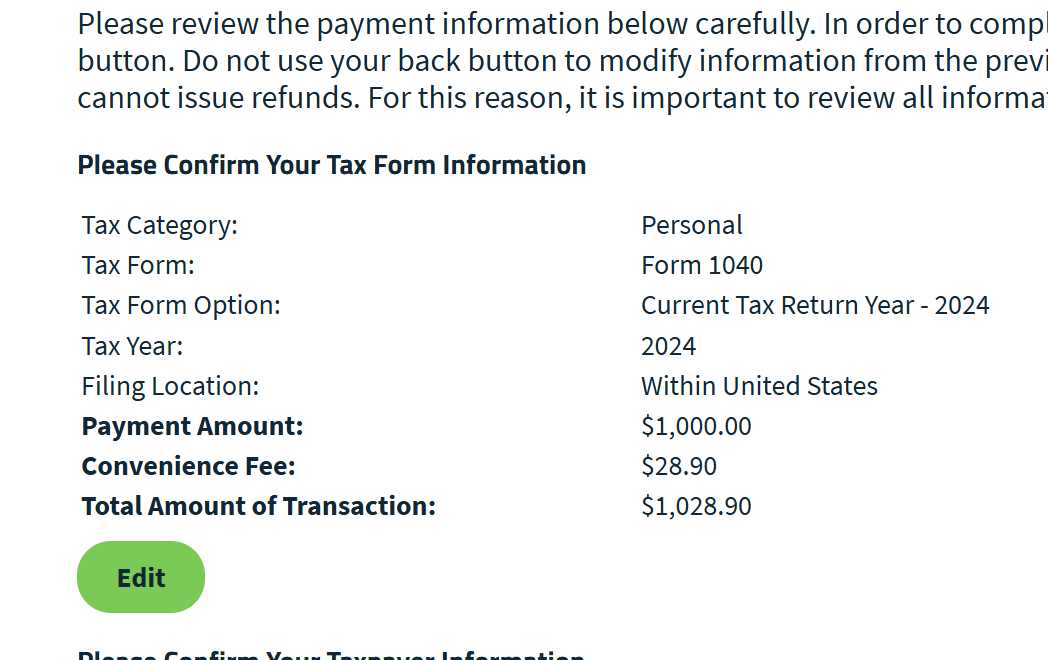

Curious if this may be a case of a mistaken display on the Pay1040 website, I clicked through and went through the motions to check the fee. Sure enough, the system is charging 2.89%.

That would be an increase of about 1% year-over-year in the fee to pay taxes with a credit card, which adds up to a sizable hit for those with large tax bills. If this increased fee sticks, it’ll essentially only make sense to pay taxes with a credit card if you’re working on a welcome bonus (or perhaps if you’re paying with the US Bank Smartly Visa and you have $100K with US Bank).

The good news is that ACI Payments is still charging 1.85% at the time of writing. If you need to make a near-term tax payment, that would obviously be a much cheaper choice.

We don’t yet know whether this change is intentional and the IRS website is displaying the old/inaccurate 1.75% rate or if Pay1040 has it wrong with the 2.89% fee. Making this all really strange is the fact that Pay1040 just reduced the rate to 1.75% a few days ago and the third payment processor dropped out altogether.

This much is certain: paying taxes with a credit card is a situation that is very much in flux at the moment. We’ll continue to keep our eye on this in the coming days and hope to see a (better) update.

The post [Update: Only affecting business cards & Amex cards] Pay1040 seems to increase fee to 2.89% for tax payments appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.