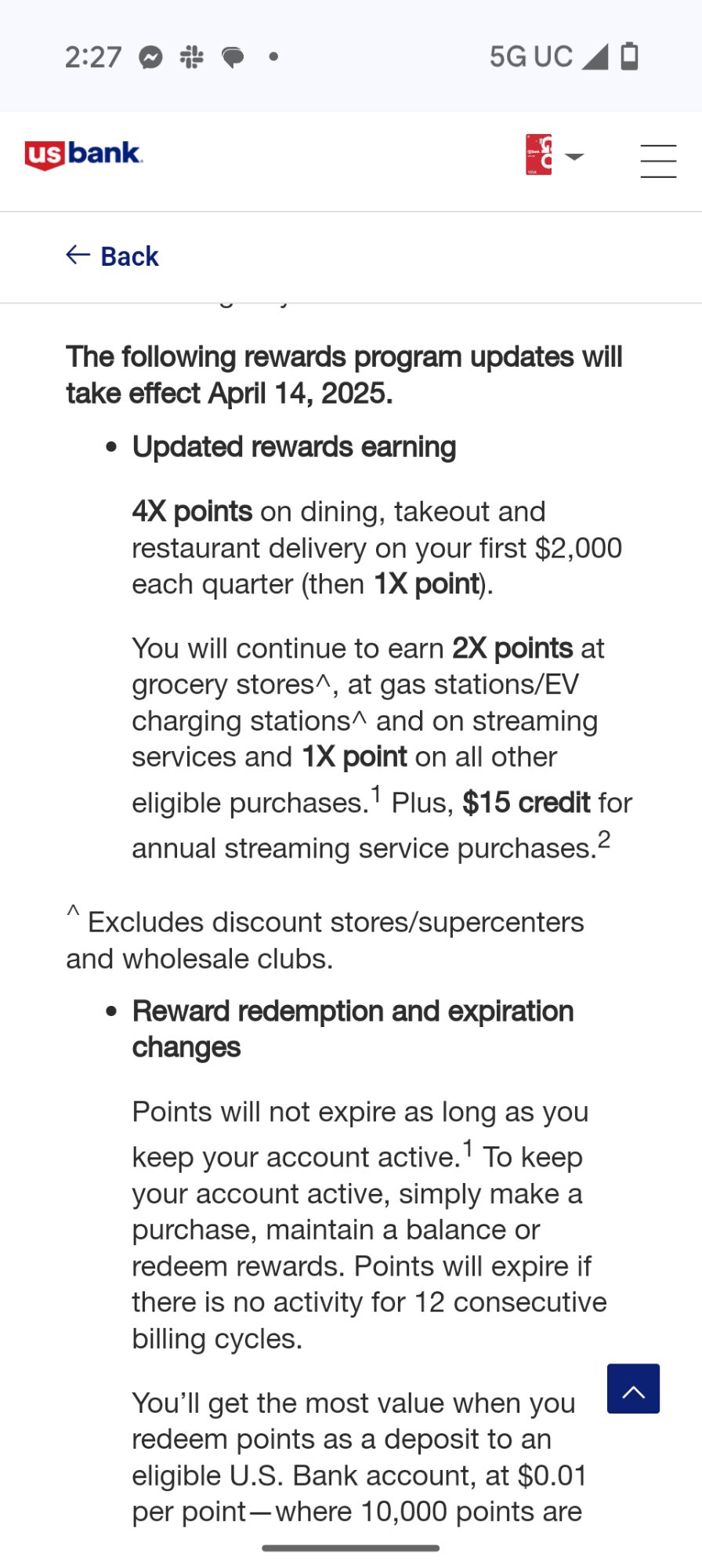

The US Bank Altitude Go card has been a great card to have in the wallet for a cash back enthusiast / those averse to annual fees. The card offers 4x on dining, takeout and restaurant delivery, which has been uncapped. I’ve often carried the card as a backup in situations where my Amex Gold card isn’t accepted. However, when logging in to my account today in the mobile app, I noticed a link to an announcement saying that, beginning on April 15, 2025, existing cardholders will be limited to earning 4x on the first $2,000 in dining, takeout and restaurant delivery purchases each quarter. That’s probably enough to meet needs for many folks, but for some it will introduce some headache in tracking.

Quick Thoughts

I noticed the above when logging in to my account on the US Bank mobile app.

This certainly isn’t the most popular rewards card on the market given pretty pedestrian earnings apart from dining. I have the card because my old Club Carlson card got converted to a Radisson card and then when Radisson got acquired by Choice Privileges, US Bank converted Radisson cardholders to the Altitude Go. Since the card has no annual fee, I didn’t see any reason to close it. And the card offers a $15 streaming services credit after 11 consecutive months of charging a streaming service to it, so I charge my Spotify subscription to the card and save $15 a year without any annual fee. As noted above, I have sometimes carried the card as a backup for dining purchases.

Moving forward, my own behavior won’t change much — since the Altitude Go is only a backup dining card for me, I wouldn’t be anywhere near the $2,000 quarterly dining cap with it. However, since acquiring the Capital One Savor card, I’ve been mostly carrying that card as my dining backup card since that card earns 3% cash back that can be converted to 3 Capital One miles, adding the flexibility to redeem for more value without sacrificing a lot of cash value.

With the US Bank Smartly card offering a base rate of 2% cash back everywhere and 2.5% back everywhere with $5,000 in cash or investments held with US Bank and a Smartly Savings account, and plenty of other 2% back cards on the market, it’s hard to get excited about the 2x categories on the Altitude Go (which aren’t changing). I’m not necessarily in a hurry to cancel mine, but I wish I could get US Bank to let me product change it to something more useful.

The announced changes also include “discounts of up to 5% on dozens of name brand gift cards” (coming sometime in 2025) and a “new Travel Center” that is powered by Booking.com. Given that those redemptions are expected to yield less than 1c per point in value, you’d probably be better off redeeming rewards for deposit to a US Bank account at a value of 0.01 per point.

The post Dining rewards earning cap coming on US Bank Altitude Go card appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.