Many cardholders don’t realize that’s possible to move rewards between your own accounts online. I can even move rewards from cash back on my wife’s Spark Cash card to miles on her Venture or Venture X cards. When you do this, the conversion rate is $0.01 = 1 mile and it’s worth noting that you can’t move in the opposite direction.

![a screenshot of a computer screen]() Why is this exciting?

Why is this exciting?

This can be very exciting for several reasons:

- Capital One offers several cards that earn excellent category bonuses on dining, grocery, entertainment and so on. By converting, it’s possible to earn 3x airline miles in those categories.

- It’s possible to convert welcome bonuses from cashback cards (including those earned on the business side) into miles.

To the first point, the Capital One Savor Cash Rewards Credit Card has no annual fee and earns 3% back on dining, grocery and entertainment, which means 3x miles per dollar if rewards are converted 1:1 to the Venture X, Venture or VentureOne cards.

Remember that the Venture X, Venture and VentureOne cards convert to airline and hotel partners at the same ratios. Someone who wants to earn airline miles for dining and entertainment purchases could theoretically pair the Savor card with the VentureOne card and earn 3x on dining and entertainment without an annual fee and convert 1:1 to partners like Avianca LifeMiles, Wyndham, Asia Miles, and more. That’s awesome.

Furthermore, since Capital One allows you to combine rewards with other cardholders, it should be possible for a Savor cardholder to share their rewards with another cardholder who has the Venture or VentureOne card as well.

A key Capital One weakness is that there are not many ways to earn Capital One miles from new card bonuses or category bonuses. Converting opens up additional new card bonuses and category bonuses from the other Capital One credit cards. In fact, it can even open up earning and sharing between the business and personal sides.

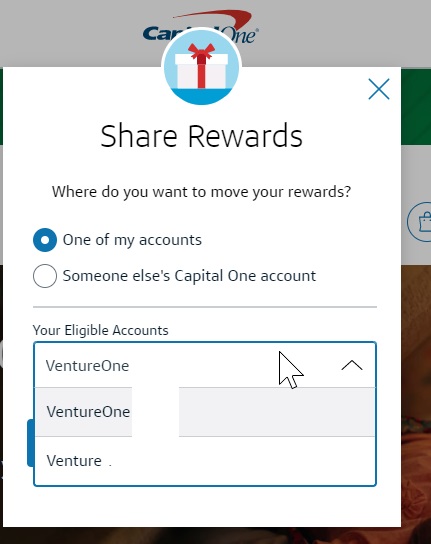

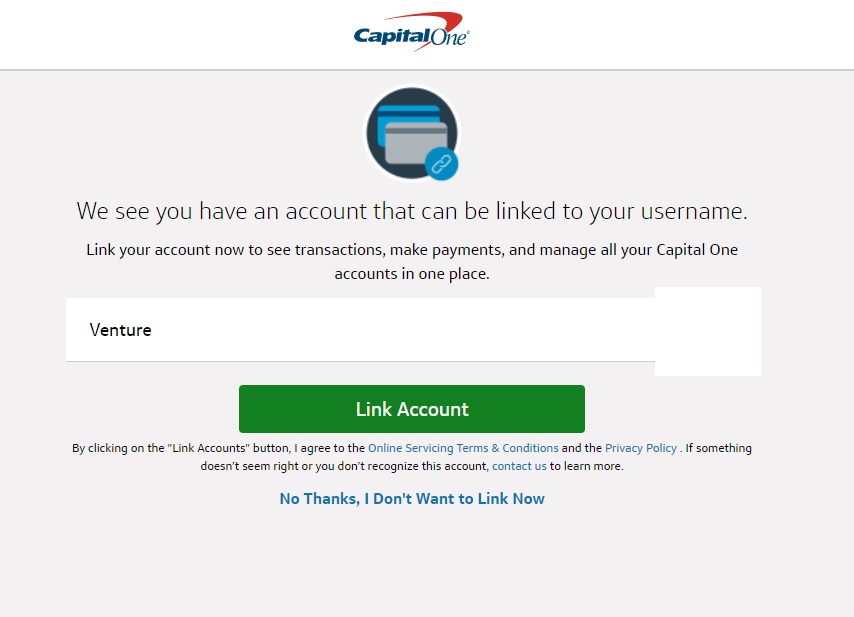

For instance, my wife has the Capital One Spark Cash Business credit card. She also has both the Venture and VentureOne cards. If she goes to her Spark Cash account and clicks to “View Rewards? and then “Move Rewards” to one of her own accounts, this is what she sees in the drop-down menu:

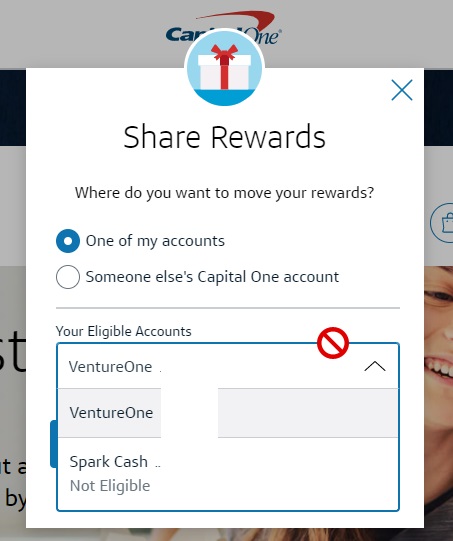

You might assume that she could only transfer rewards between the Venture and VentureOne accounts. However, when she goes to her Venture account and chooses to move rewards to one of her own accounts, this is what she sees:

Note that it says her Spark Cash card is not eligible. In other words, she can’t convert Venture miles to her Spark Cash card. However, in the opposite direction, it does not indicate that her Venture accounts are not eligible — so converting cash back earned on a Spark Cash card to miles works.

That’s huge because we sometimes see very big bonuses on the Spark side — being able to convert a $1,000 or $2,000 Spark Cash bonus into 100K or 200K miles is awesome. Furthermore, spending on the Spark Cash would make more sense than spending on a Venture card because the Spark Cash card would give the flexibility of redeeming rewards for straight cash (not only to reimburse travel purchases) or convert to miles.

How to move rewards

In order to move rewards, go to your Capital One card account and click “View Rewards” under your card name in the top left of the card account.

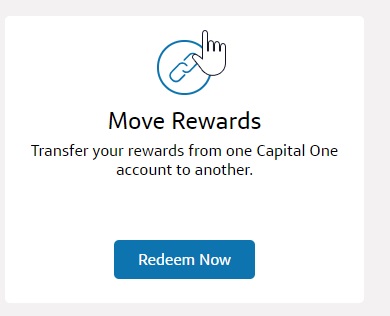

Then select “move rewards”.

If you want to move rewards to someone else’s account, you’ll need to call the number on the back of your card and provide the card number of the person to which you are moving rewards.

Bottom line

It’s possible to convert rewards earned on Capital One cash back to miles on a Venture X, Venture or VentureOne card, which is terrific for those looking to accumulate miles with bonus categories or welcome bonuses.

The post How to convert Capital One cash back to miles by moving rewards appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

Why is this exciting?

Why is this exciting?