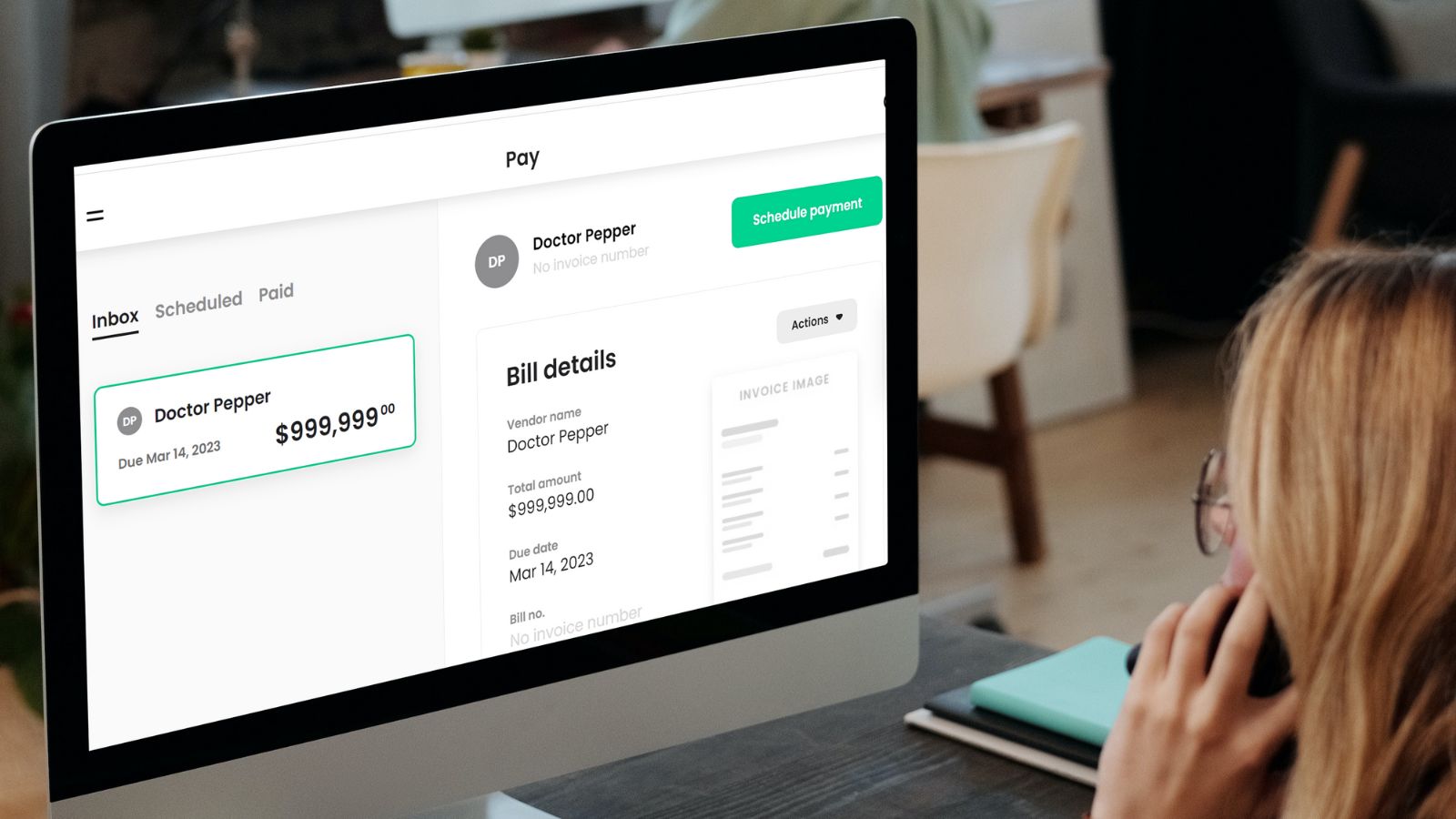

Melio is a service intended to simplify paying business bills. Melio lets you pay bills with a credit or debit card for a 2.9% fee, or for free with bank-to-bank ACH transfers. Melio users can pay vendors through whichever means they prefer (i.e. ACH for free up to 5 times per month, or credit card with a 2.9% fee).

It can make sense to pay the 2.9% fee if you want to increase spend in order to earn a large welcome offer or a big-spend bonus (for example, some credit cards offer free hotel nights or elite status with big spend). Unfortunately, you cannot pay personal bills with Melio.

If you’re interested in trying Melio, you’ll find a welcome offer below for $200.

Image may be NSFW.

Clik here to view.

Why use Melio?

Here are some reasons you may find Melio compelling for paying business bills that can’t usually be paid by credit card:

- Earn credit card rewards. This can be especially compelling when you need to increase spend to earn a large welcome offer or to earn a big-spend bonus (for example, some credit cards offer free hotel nights or elite status with big spend).

- Keep your cash for up to 45 extra days. With a service like Melio, you can pay your vendors immediately, but wait until your credit card statement is due to pay off your credit card bill.

Melio Welcome Bonus: $200

Sign up for Melio with Frequent Miler’s unique link, and then you’ll earn $200 back via bank deposit after you’ve completed one of the following requirements:

- Make payments totaling at least $2,000 using credit cards (or International Payments or Fast Payments) during your first 30 days;

or… - Subscribe to the Melio Core or Boost subscription tiers, and keep the subscription beyond the end of the free trial period (if applicable).

We have an affiliate relationship with Melio in which we’ll earn a commission after you complete the terms for earning your own bonus (as long as you click through our link to sign up). We negotiated a special offer with Melio to increase your welcome bonus (most sites offer a bonus of only $100).

How to earn $200:

- Sign up for Melio here: Frequent Miler’s Melio link.

- Upload a bill or an invoice.

- Either:

- Make payments totaling at least $2,000 using credit cards via Melio Pay,

or: - Subscribe to the Melio Core or Boost subscription tiers, and keep the subscription beyond the end of the free trial period (if applicable).

- Make payments totaling at least $2,000 using credit cards via Melio Pay,

That’s it, Melio should then deposit the $200 cashback to the bank account you provided.

Welcome Offer Terms: For a user to be eligible to receive the one-time $200 cashback, a user must be a new user of Melio who successfully subscribed to Melio through this page and meet the criteria below per their subscription type: 1. The user subscribed to the Melio Go subscription tier and initiated and completed Payments totaling at least US$ 2,000.00 using Credit Card, International Payments or Fast Payments during their first 30 days of subscription; or 2. The user subscribed to the Melio Core or Boost subscription tiers, and have not canceled their subscription before the end of the free trial period (if applicable). Eligible users will receive the cashback by bank deposit. Melio reserves the right to end the promotion ahead of time or to make changes or additions to this promotion for any reason at any time. Melio reserves the right to withhold the cashback in case of fraud or abuse and subject to its Terms and Conditions. This promotion is not available to accountants’ clients and/or businesses added and/or managed by accounting firms on the Melio platform.

Melio Pricing

Melio charges 2.9% to pay with a credit or debit card. Additionally, Melio charges $1.50 per check after the first 2 free checks each month.

Frequently Asked Questions

Who can use Melio?

Almost any U.S. based business, including sole proprietor businesses, can use Melio to pay business bills.

Businesses cannot use Melio if they are involved with any of the following:

- Gambling and related activity

- Multi-level marketing firms or any agents that represent them

- Sales of tobacco, marijuana, hemp, pharmaceuticals, supplements, nutraceuticals, or paraphernalia.

- Pornography, obscene materials, or any sexual/adult services

- Weapons, ammunition, gunpowder, fireworks, and any other explosives

- Toxic, flammable, or any radioactive material

- Gold, silver, diamonds

- Other goods and services subject to government regulation.

What types of payments are allowed with Melio?

Melio offers the following examples of payments that are allowed:

-

Rent (when your landlord is a business not an individual)

-

Taxes

-

Utilities

-

SaaS & app-based expenses

-

Franchising and operating expenses

-

Legal expenses

-

Accounting & bookkeeping expenses

-

Freelancers/contractors

-

Inventory, raw materials, and supplies

-

Professional services

-

Maintenance services

-

Donations

-

Employee reimbursements

-

Credit card debt (not with a credit card)

-

Loan payments (not with a credit card)

-

Mortgage payments (not with a credit card)

-

Pre-payments (only with ACH bank transfer)

Which credit cards can I pay with?

- American Express: Limited to certain industries

- Visa business cards

- Mastercard

- Discover

What types of payments are allowed with Amex cards?

The use of American Express cards is only supported in the following industries:

- Education

- Government

- Rent

- Utilities

- Membership Clubs

- Professional Services

- Business Services

- Inventory/Wholesale

- Construction/Logistics

Can I make payments with Visa/Mastercard/Amex gift cards?

No. Melio does not allow payments from prepaid cards.

Can I use Melio to pay a 1099 Contractor?

Yes. And your contractor can select how they want to receive payment: check or ACH.

Note that Melio typically asks for one of the following for verification purposes: Trade License / Business Registration, Doing Business As (DBA) Registration, Previous Schedule C filing, Most recent sales tax filing, Business utility bill under sole proprietor or DBA name, Sole proprietor bank statement.

What types of payments are not allowed with Melio?

Melio prohibits all of the following uses:

- Personal payments (i.e. payments for a non-business entity)

- Card network specific restrictions

- Payments from prepaid cards

- Balance transfers (paying a credit card balance with a different credit card)

- Cash advances: payments from a credit card to a business owner; to the business from its owner; to another entity in which the cardholder controls or has interests). This is also extended to household members and relations.

- Payroll transactions (though freelancers and contractors are supported).

- Pharmaceuticals, including for animals

- Flammables

- Explosives

More examples of payments that are not allowed can be found here.

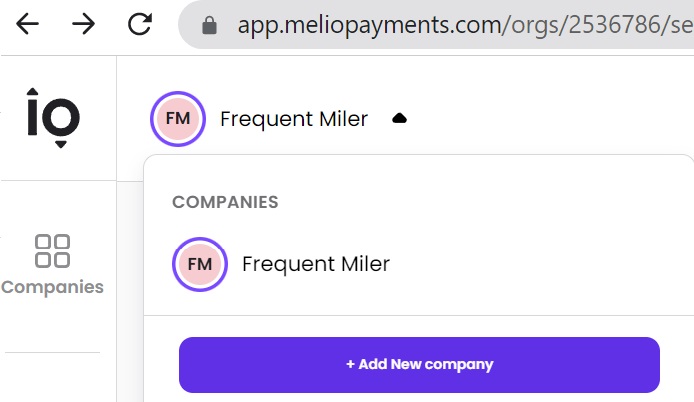

Can I earn multiple welcome bonuses if I have multiple businesses?

Yes. Plus, a cool thing about Melio is that you can add additional companies from a single log-in. Simply click your company name at the top, left of your browser and you should see an option to “Add New company”.

Image may be NSFW.

Clik here to view.

The post Melio: Pay business bills by credit card appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.