Chase has arguably long offered the best automatic travel protections of any card issuer. This has been especially true for Sapphire Reserve and Ritz cardholders who get what I often describe as “best in class” protections such as 6 hour trip delay coverage and emergency medical & dental. But even lesser cards like the Sapphire Preferred and many of their airline and hotel branded cards have very good travel protection benefits relative to competitors. Chase may still have the best credit card protections, but in some cases they’re not what they used to be. One feature that many Chase cards offer is Trip Cancellation and Interruption insurance. It used to be the case that if you paid for all or part of a trip to their card, you were fully covered for this benefit. Now, that’s no longer the case…

Pay Partial: Possible but mostly useless for trip cancellation and interruption insurance

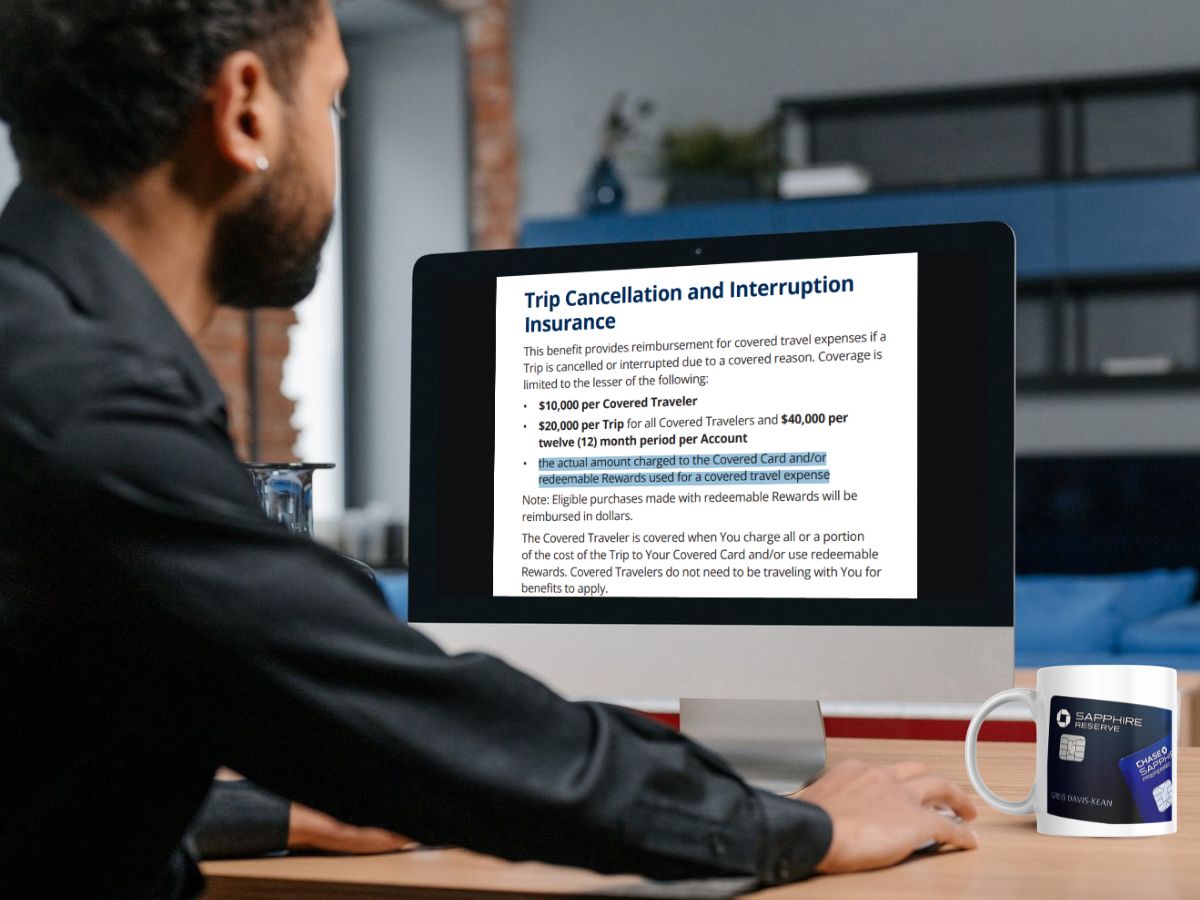

One of the reasons I routinely use my Sapphire Reserve card to pay fees associated with award bookings is that many of the travel benefits are fully covered as long as you pay any part of the trip with your card. That’s still true except with trip cancellation and interruption insurance. With trip cancellation and interruption insurance, the new benefit guide claims that the traveler “is covered when You charge all or a portion of the cost of the Trip to Your Covered Card and/or use redeemable Rewards,” but it also states that coverage is limited to “the actual amount charged to the Covered Card and/or redeemable Rewards used for a covered travel expense.”

So, yes, if you use your Chase card to pay for the taxes and fees for an award booking, you will be covered for trip cancellation and interruption, but the maximum coverage is limited to the amount charged to the card. When you pay $5.60 to book an award flight, I’d argue that it’s not worth the time to file such a claim.

I found similar language on all of my Chase cards that offer trip cancellation and interruption insurance: Ritz, Sapphire Reserve, Sapphire Preferred, Ink Business Preferred, United Gateway, United Business, IHG Select, IHG Premier Business, World of Hyatt, World of Hyatt Business, etc.

I wondered about the part that says coverage is limited to… redeemable Rewards used. When booking an award flight, would they somehow account for the value of the miles used? I called Chase to ask and was forwarded to their claims department. There, I was told that the “redeemable Rewards used” refers to paying with credit card points, and does not consider other rewards such as miscellaneous airline miles.

Pay partial: still effective for other travel coverage

The good news is that I did not find similar language on other travel protections. Specifically, with the Sapphire Reserve card at least, all of these protections are still fully covered when you pay partially with your Chase card:

- Baggage Delay Insurance

- Lost Luggage Reimbursement

- Trip Delay Reimbursement

- Travel Accident Insurance

- Emergency Medical and Dental

- Emergency Evacuation and Transportation

Other options?

I haven’t yet found another credit card option that offers full trip cancellation and interruption coverage when paying partially with your card. There are a few that offer full coverage if you pay with your card and/or with rewards associated with the card, but none that I’ve found that offer full coverage when only pay a small amount with the card or the card’s rewards. If you find one, please let us know! In the meantime, I’ll still use my Sapphire Reserve to pay partially for travel but with the knowledge that I’m no longer effectively covered for any losses above the amount charged to my card or paid with Ultimate Rewards points.

The post Chase tanks “pay partial” trip cancellation and interruption insurance appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.